Purpose of this report: Understand the IT opportunities driven by accelerated digital transformation in SMBs and key considerations for sellers/marketers in the IT channel ecosystem.Why focus on SMBs?

Small-and medium-sized businesses (SMBs) are the world’s most powerful growth engine[1]:

Representing ~90 percent of all global companies

SMBs contribute to half of global GDP

Over half of the world’s employment

Worldwide IT spending by SMBs is expected to reach USD 684 billion in 2021 and is increasing at a rate faster than the GDP growth rate.

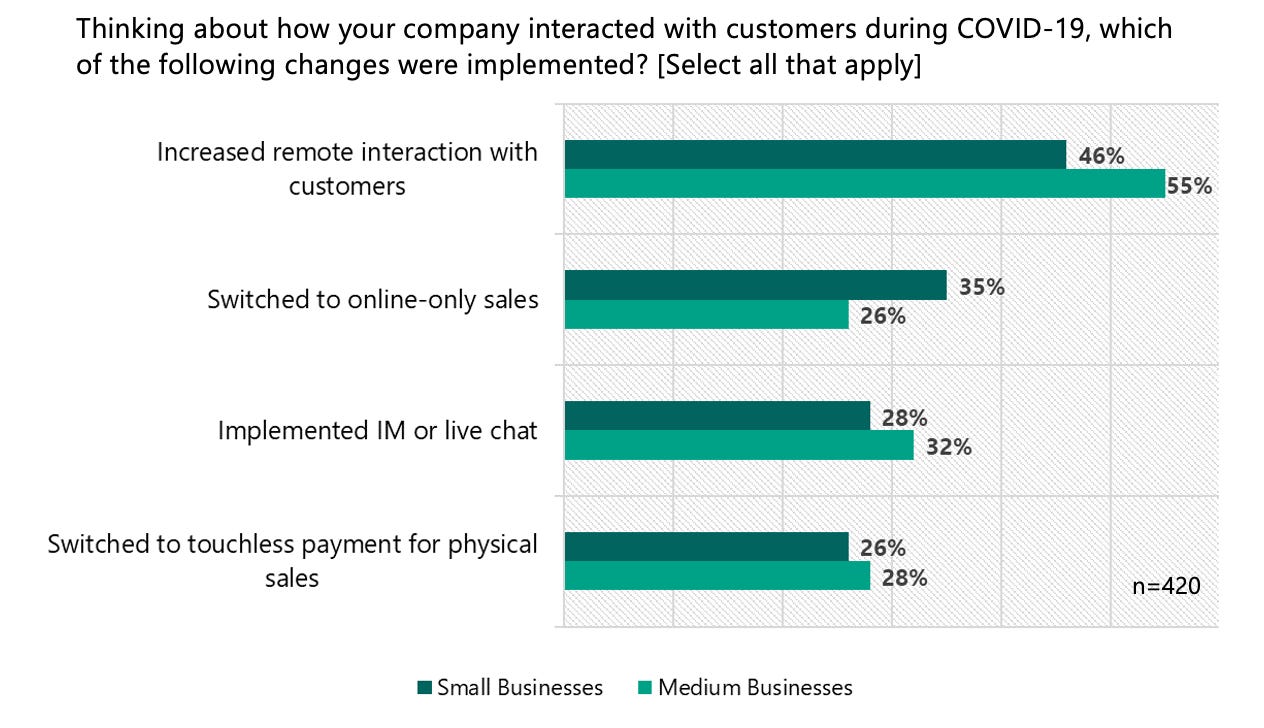

SMBs were forced to change the way they interact with customers during the pandemic[2]

COVID-19 accelerates the shift to digital[3]

SMBs rethink how they operate and engage with their customers.

97% of SMBs provided support for employees WFH during COVID-19: WFH is not right for all employees, but SMBs must provide the right tools to support productive remote working where necessary.

48% of SMBs expect to increase spend on broadband after COVID-19: SMBs’ demand for reliable connectivity services is set to rise post COVID, both in the office and to support remote/home workers.

63% of SMBs expect to increase use of public cloud in the next 12 months: Driven by different ways of working and interacting with customers, demand for packaged cloud & security solutions will increase.

47% of medium-sized businesses are using online employee training: The shift to online sales & operations drives demand for a wide range of business intelligence, analytics, e-commerce, and digital services.

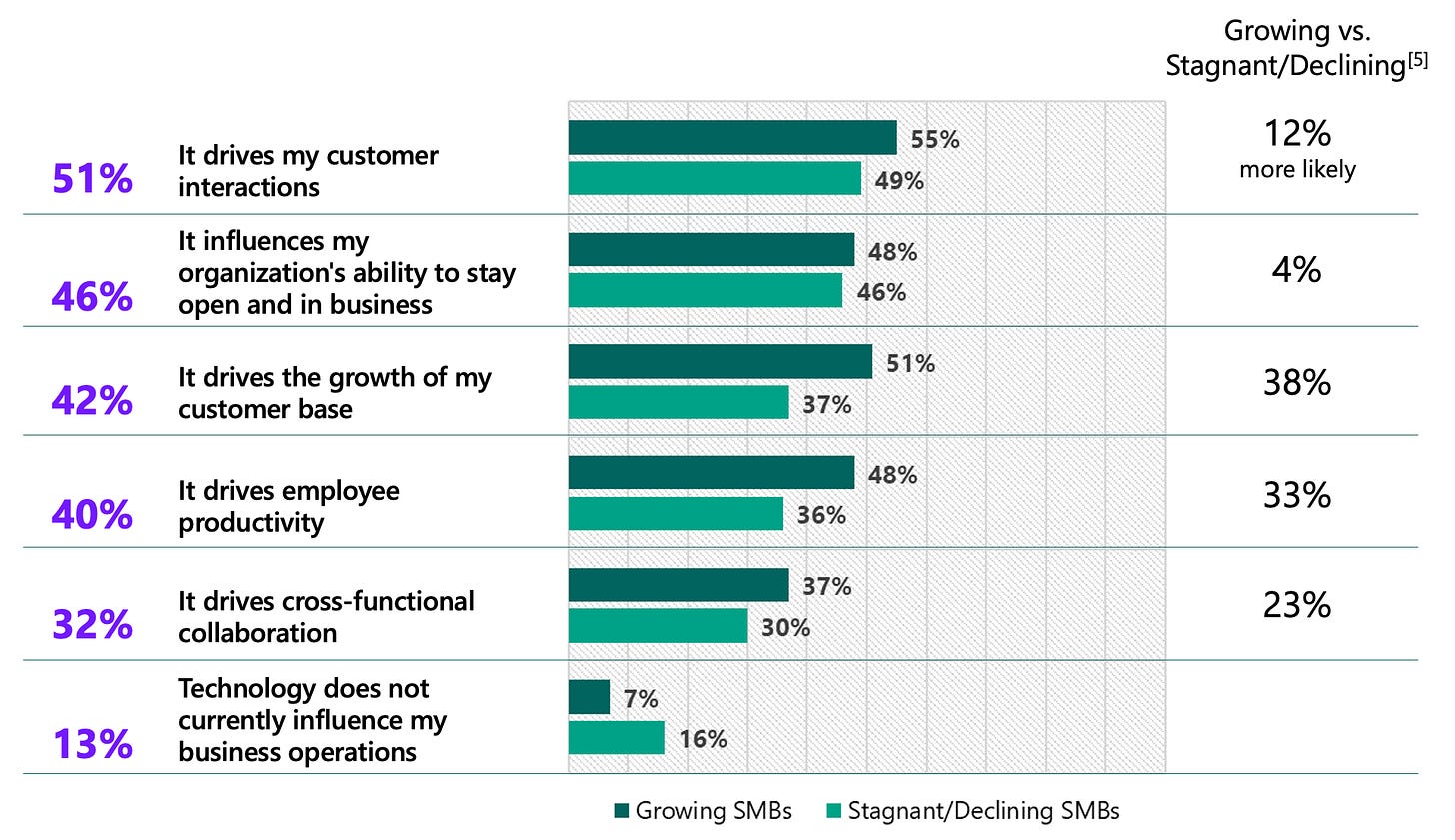

Digital-forward SMBs are better equipped to handle market volatility[4]

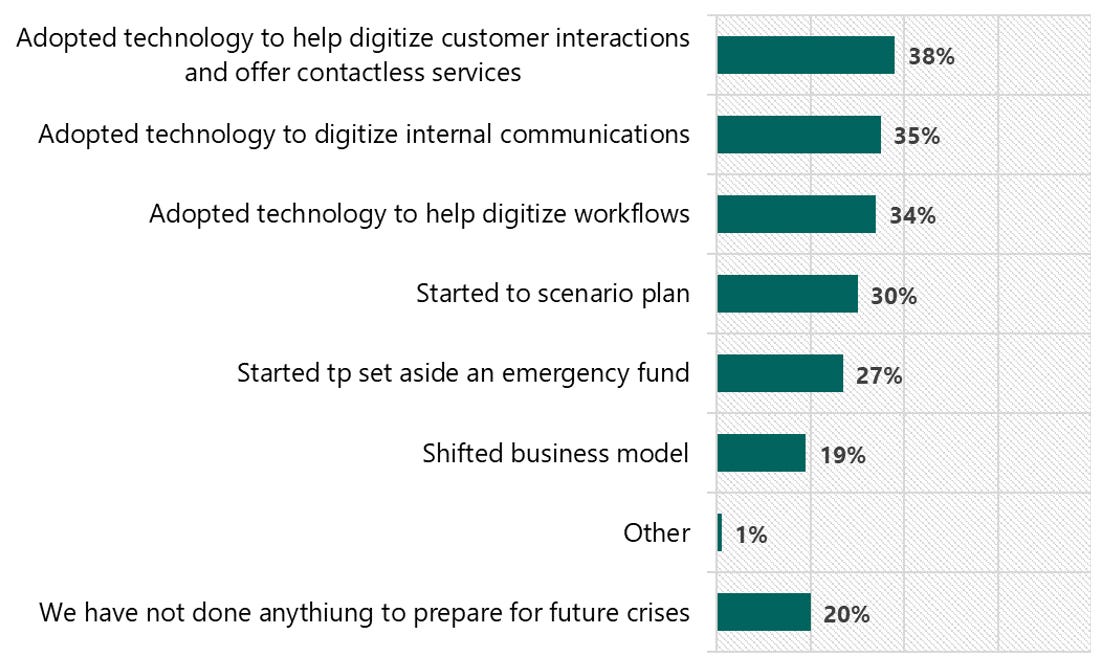

Actions SMB leaders have taken to prepare for future crises

It has been a whiplash moment for the SMBs:

The pandemic has shaken local economies around the world to the core, and SMBs are at the epicenter

60 percent of SMBs experienced sales decline during COVID-19[2]

18 percent of medium businesses laid off workers, and 40 percent furloughed some[2]

Recovery will be Digital, driving rapid technology adoption for building business resiliency[4]

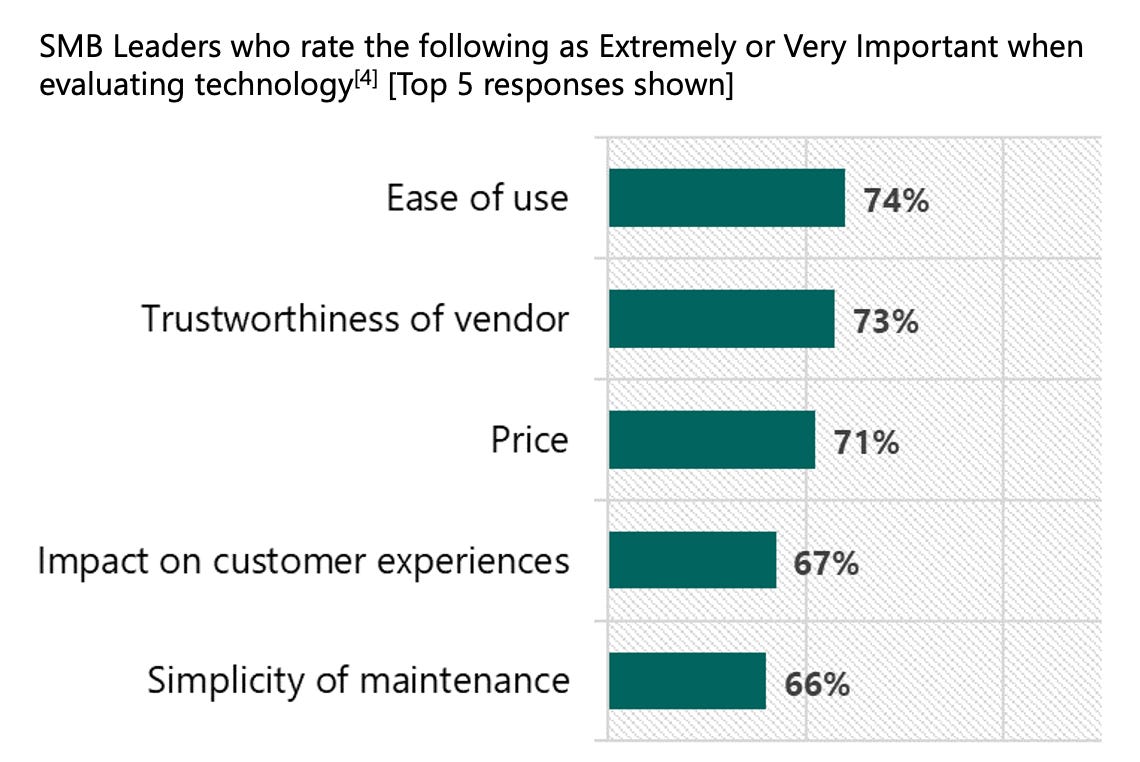

What do SMB leaders look for during technology investment?

52 percent of SMBs are planning to increase investments in Digital Transformation[6]

IT vendors should become the lighthouse to guide the SMBs to navigate through their digital transformation journey safely.

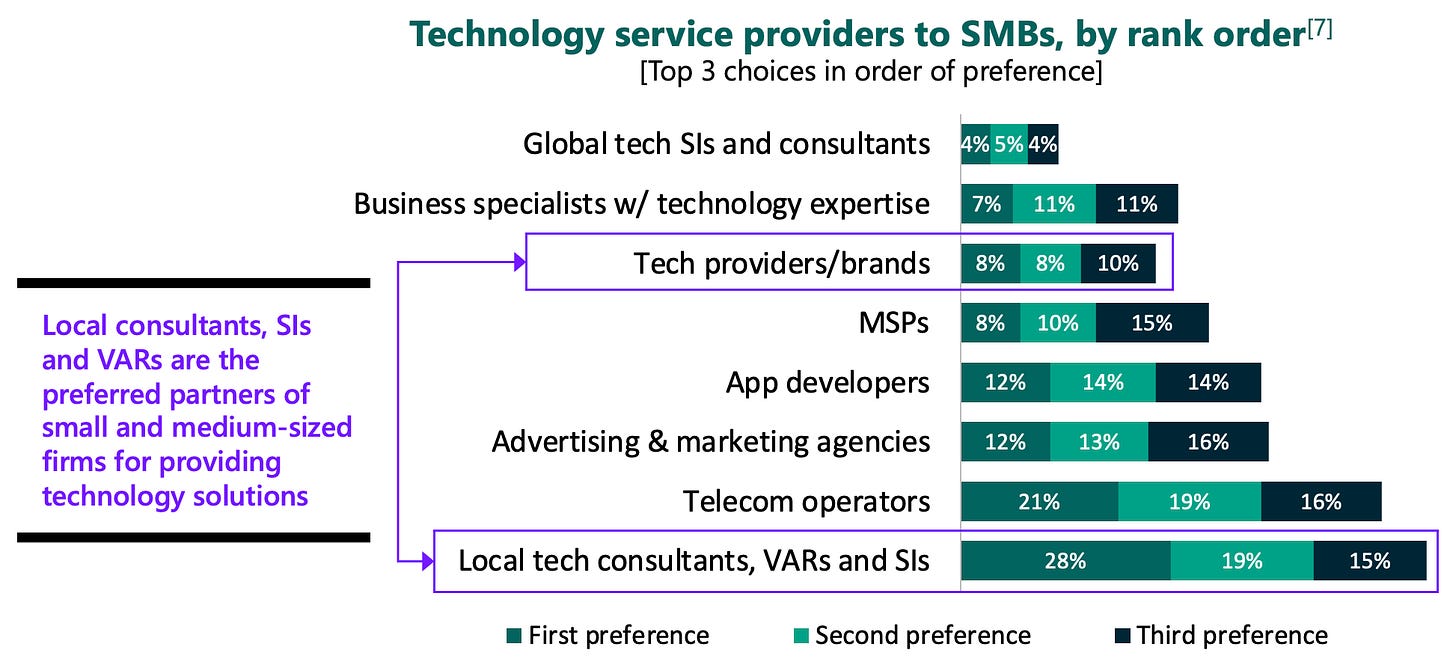

Preferred Routes-to-market for SMBs

The SMB market is highly contested; none of the service providers addressing it can afford to be complacent[7]

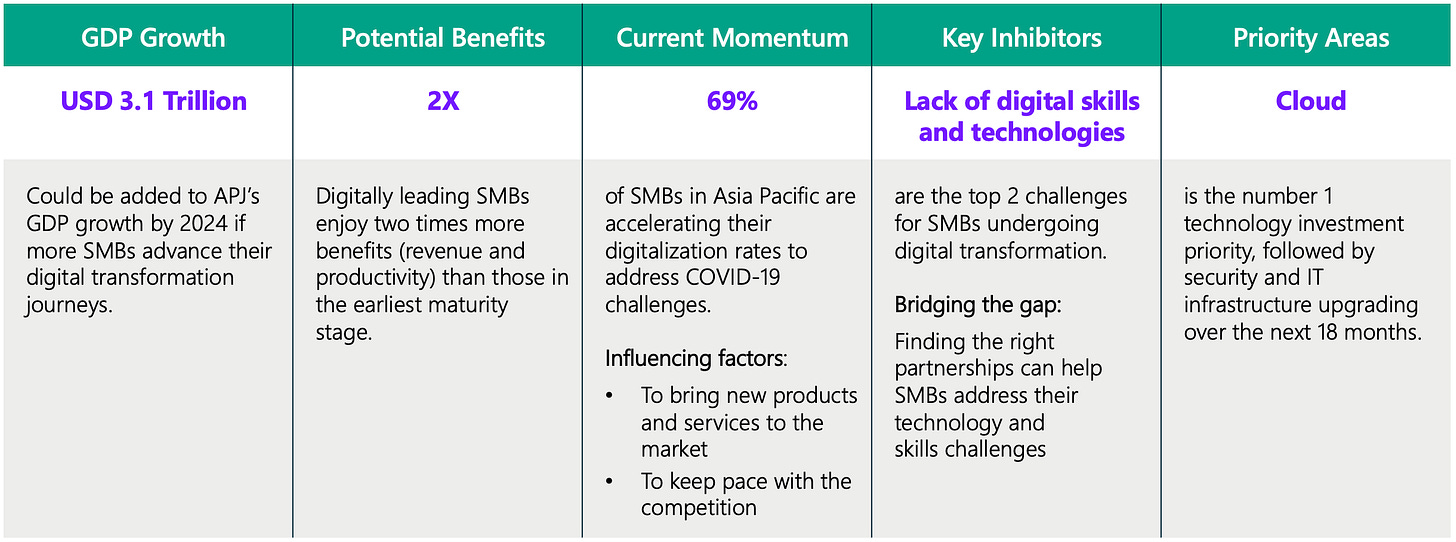

SMB Market Opportunity in APJ[8]

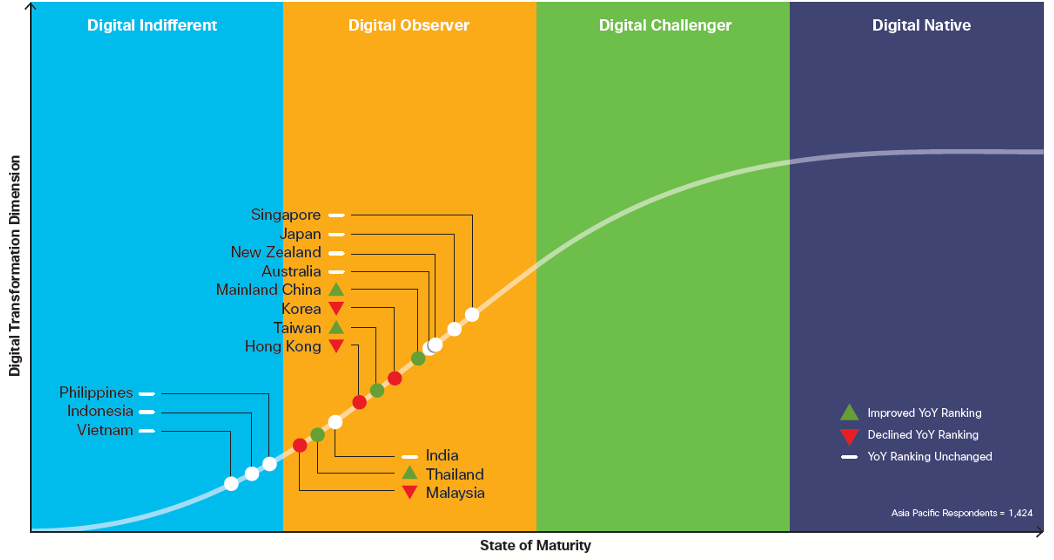

Digital maturity of SMBs in APJ[8]

Nine out of 10 SMBs in the Asia Pacific are more reliant on technology to sustain their business during COVID-19.

Also, over 80% believe that digitalizing their businesses will help them become more resilient and adaptable to market change or future crises.

SMBs need the most help in rightsizing digital technologies to drive growth.

The Next Normal for Sellers & Marketers

It’s not about hitting your numbers. It’s about hitting theirs.[9]

Only the relevant will thrive[10]:

SMBs today are typically 72 percent through their buying decision before they contact a sales rep or partner.

Differentiated content must be created. This needs to be personalized, easily shareable (ROI calculators, mixed reality demos, and portals), and designed to create internal evangelists.

Research indicates that the right dimension to personalize content is less about an SMB’s geography and its revenue, and much more about the age of the SMB, its FTE headcount, and industry sector.

[1] Powering SMB Resiliency in a COVID-19 world, Accenture

[2] Rebuilding business, Accenture

[3] Rebuilding business, Accenture

[4] Small & Medium Business Trends Report 4th edition, Salesforce Research

[5] Responses of (Growing – Stagnant/Declining) / Stagnant/Declining

[6] SMB Techaisle Take, April 27, 2020

[7] Small and medium-sized businesses: technology buying behaviour and channel preferences, Analysys Mason

[8] 2020 Asia Pacific SMB Digital Maturity Study, IDC/Cisco

[9] Build Your Sales Team for 2025, Salesforce

[10] Think big in a small world, Accenture